Are you planning to write an employee expense policy but don’t know where to start? You’re not alone.

An expense policy is a document that guides employee spending. It’s a vital tool to help prevent inappropriate expenses, ensure fairness, and protect your company’s bottom line.

So, it’s important to get it right and create an effective policy that adds value to your company and your staff.

It’s no surprise that many people find writing them daunting, but it doesn’t have to be. With these simple tips, you’ll be able to write an effective policy in no time.

Download your free expense policy template

1. Keep it simple

Anybody and everybody in your company needs to be able to understand your expense policy, use short sentences and avoid jargon as much as possible.

Use a structure with clear headings and bullet points. You can even include tables and flowcharts to make it easier to process.

2. Be clear and consistent

Avoid ambiguity because if employees don’t understand your policy, then they won’t follow it. So, keep your guidelines as simple as possible, and avoid any unnecessary detail.

It’s also a good idea to have consistent guidelines that apply to everyone in the company, irrespective of their role. Less nuances and exceptions result in a shorter policy that’s easier to remember. Plus, many staff will think it’s fairer.

3. Know your budget

Having a budget is crucial. It will influence your policy spending limits and categories and ensure that it protects your bottom line.

Plus, it will impact how detailed and stringent your policy will be. If your budget is limited your policy will reflect that as you’ll need to encourage staff to be more careful with their expenses.

4. Be reasonable

Ensure that you’re being flexible enough with your spending rules. If employees are spending hours searching hotels or other products under the limit, then they’re wasting valuable time. Get the most out of your staff, by being reasonable with the limits you set.

5. Collaborate

The best way to understand what staff need to do their job and how much things cost is to talk to them. It’s also a great way to test how easy your employee expense policy is to understand, follow and remember.

6. Update it regularly

It’s good practice to review your policy at least once a year. Regularly updating your policy, ensures that it meets the needs of your company.

Updating your policy is a chance to find new suppliers and negotiate deals for regular custom. So, it can also help you cut costs.

It’s also an opportunity to keep up with new technology and legislation.

7. Use an expense management solution

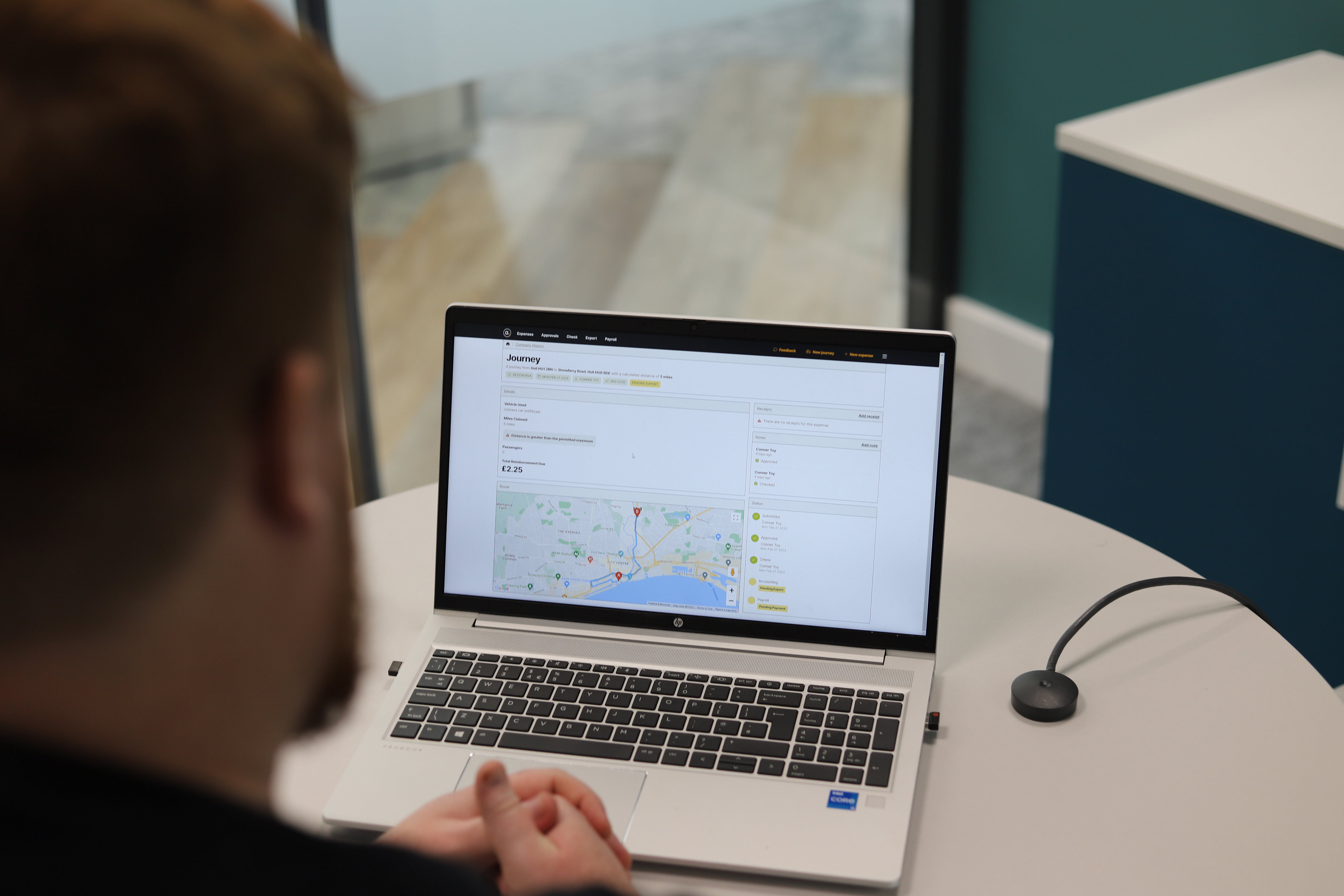

Using an expense management solution is a great way to take your policy to the next level by increasing compliance.

Even if you have a great employee expense policy, staff can and do forget policy rules. They can also forget to keep their receipts and register their expenses.

Fortunately, virtually all expense management solutions worth their salt include spending limits and category restrictions, which prevents overspending and inappropriate purchases before they happen.

These tools also improve processes by increasing receipt capture and automating expense reports. Staff don’t have to worry about keeping receipts, filling in expense forms or submitting them on time. Instead, they are prompted to take a picture of their receipt and register their expense whenever they make a purchase. Managers can then approve their expenses in real time.

For more ideas on using technology to take your employee expense policy to the next level, check out our article on automation.